The four areas you will read about in this series are more under your control. They do not come without costs, but they do pay off handsomely and, more importantly, will help you with operational efficiencies and better earnings if done correctly. The four parts of the series are about numbers, organization, technology, and infrastructure. After years of dealing with business owners, as well as owning a few of my own businesses, it is painfully true that business owners like the work they do, but not other things in support of their business focus. Most important to this is record keeping. It is a necessary evil: You need it for the banks, you need it for the government, and you need it for yourself (for example, when you need to collect money others owe you).

Consider this one truism: If your record keeping is done well, it becomes an ASSET of the business. What does that mean? Well, you generally either use assets or create them for sale; but does that apply to business records? The simple truth…YES.

Business records are an asset because they have value. Not the paper or computer data itself, but the mere ACCURATE RECORDKEEPING you maintain will add to the value of your business. If that is the case, then you should look at record keeping as an investment – not a cost.

Consider this, and it may shock you, but if you had your corporate books audited for three to five years BEFORE you sold the business, that alone could increase the consideration (money) paid to you as much as what you earn in a full year. So, if you make $500,000 per year, by just auditing what you already do as part of the business operations, you may add $500K to your pocket.

How many units sold or hours of services would your business have to sell in order for YOU to get an extra $500K in TAKE HOME pay?

In a business, most business owners will keep their records as simple as possible. Some I have dealt with over the years actually maintain very detailed and structured books. Regardless, the numbers you collect are a picture of effectively managing your business. They should not be viewed as a task that has no rewards.

The information you collect should satisfy two key criteria – financial and operational information. If done properly, and the systems you use allow for it, you can “kill two birds with one stone.” For example, recording an order and subsequent sale of a product or service should provide for both needs.

The financial information allows you to understand issues which are central to the financial well-being of your company. The lifeblood of a company must be reflected on its Balance Sheet. The Balance Sheet SHOULD reflect what you own, what you owe, and how much you are “technically worth.” What does “technically worth” even mean? Your Balance Sheet is the most important financial document you can produce, and it reflects values recorded AT COST. So, if you buy a widget, it gets recorded at cost. If the widget is still in stock a year from now, it may not reflect the current market value of the product. True market value is not reflected in your records, except if you have taken an allowance for things such as an inventory write-down.

Years ago, the cost of computer memory was so volatile, that accurate record keeping of value was near impossible because of fluctuations in what sometimes seemed hour to hour. When goods you own can be subject to incredible swings in value in short periods of time, special accounting must allow for that, and invariably, those allowances will show up on your Balance Sheet.

Keeping records accurate and up-to-date is a joint responsibility of you and your accountant. Many business owners rarely analyze their Balance Sheet, as they spend more time looking at the income statement and how much money is in the bank. However, your accountant should assist you to ensure that the numbers on the Balance Sheet are accurate and the process of recording the data is effective and timely.

You have three choices in an accountants review: compilations, reviews, and audits. Audits are not to be confused with a dreaded IRS review, but simply a review of the financial recording methods and data accuracy in conformity to Generally Accepted Accounting Principles (or GAAP as it is known). It involves a number of key areas including accurate income and cost reflection to a particular date, sample validation of external unverified data (i.e., your outstanding A/R and A/P), and an evaluation of data recording processes (i.e., inventory recording and counts). It is a long process and can seem daunting, but if you are prepared for it, it is not a cost, but rather an investment in a 1X yearly earnings return.

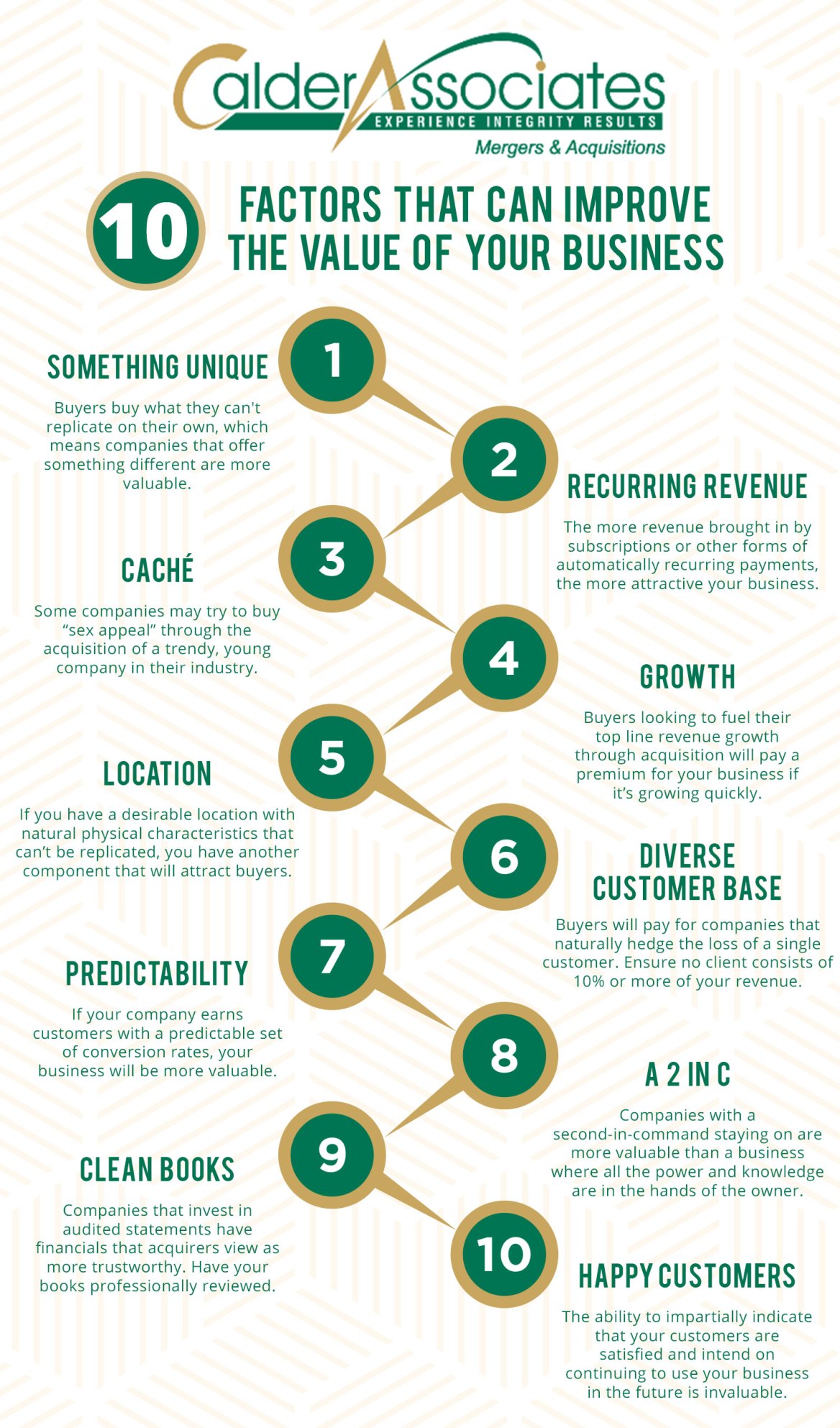

Most sophisticated buyers WILL PAY additional value for audited returns. The reason is that they can rely on the information with a greater degree of certainty. Being able to rely on that information will be beneficial to a buyer because it will save them time during due diligence, possibly allow them to get better rates on debt acquired, and reduce the risk of loss.

So, if getting an audit could lead to a 1X multiple addition, what will you get with a review or a compilation? A review is, for simplicity purposes, a mid-ground that provides a less stringent review. Your accountant will not do external validation, nor ensure proper methods in inventory counts, but they will look at your entries, make appropriate accruals, and ensure that certain accounting standards are being followed. Yet, they will NOT certify your Balance Sheet.

With a compilation, your accountant will not attempt to verify anything, and will simply present the data you provide in an acceptable financial format. As you are most likely already aware, a compilation and review are less costly—significantly in some cases. Yet, how much will your price suffer if you were to get compilations or reviews?

Compilations will not allow for any added value. In fact, it may be viewed as a negative and cause buyers to not even consider an otherwise good business. With a review, you have a much better chance of a sale, but the likely “premium” will be between 0% and 20%. The marginal difference vs. an audit is large and makes you wonder why you have not done this before.

If you do have an audit, try having at least three years of audits. If your business is saleable, the cost of an audit will almost certainly be recouped during a sale. Preparing for an audit by updating your data collection, recording methodologies and internal review will also have the secondary benefit that improves your operation and, by extension, your bottom line. So, not only will you make more when you sell your business, but you will gain better intelligence about your business and also earn more money each year until it is sold.

Consider updating your financial recording and audit possibilities. A certified or qualified intermediary can help you prepare for that eventual sale date. Working also with your accountant, your “team” may help you, as a shareholder or member, to achieve an even better return than you thought ever possible. Remember, defending your company’s value is critical in the end. Use the 4 areas worth improvement to improve your payout.